Recent Articles

06

2026

You’ve probably had the same checking account since you were sixteen. Your bank knows your name. Your debit card works everywhere. Loyalty feels safe. But when it comes to a mortgage, that “loyalty” can quietly turn into a convenience fee—and sometimes, a...

28

2026

When most homeowners hear the word refinance, they immediately think one thing: getting a lower interest rate. While that can certainly be part of the picture, it’s far from the whole story. In reality, refinancing is less about chasing rates and more about using your mortgage as a...

19

2026

If you’ve been waiting for the right moment to buy a home, this could be the sign you’ve been looking for. Mortgage rates have recently dropped to their lowest level in nearly three years, creating a rare window of opportunity for homebuyers. After a long stretch of higher...

12

2026

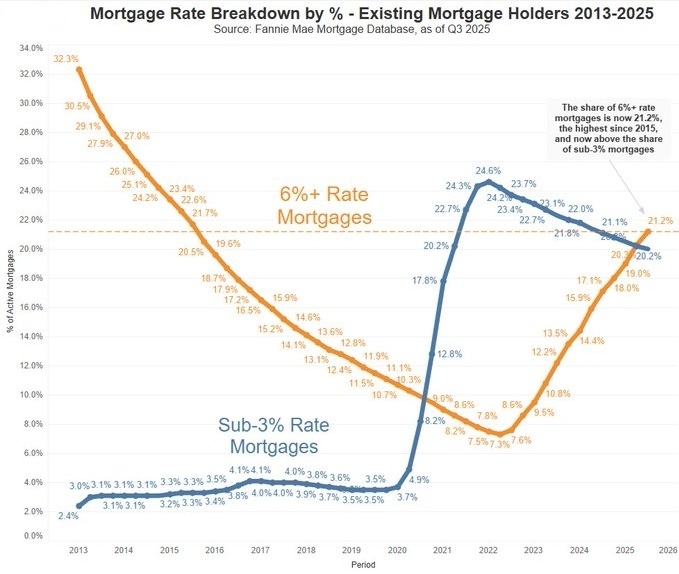

For the past few years, one phrase has dominated housing market conversations: the mortgage rate lock-in effect. Millions of homeowners secured ultra-low mortgage rates below 3% during the pandemic, creating a powerful disincentive to sell. Why give up a once-in-a-lifetime rate and...

30

2025

If the mortgage market felt unusually quiet over the holiday stretch, that’s because it was. The final weeks of December are known for “holiday trading,” which is when fewer people are actively buying and selling in the bond market. Since mortgage rates are driven by...